GO Technology: Consumers and hospitality: What 2025 habits reveal about the year ahead

No-shows remain an ongoing challenge for the hospitality industry, costing UK hospitality a collective £17.6bn a year in lost sales.

Previous research in 2024 revealed that 60% of consumers want to support the hospitality sector in light of the cost-of-living crisis, however despite this the rate of no-shows has risen from 12 to 14% over the course of the year. With increased cost pressures already presenting a difficult trading environment for hospitality, it’s vital for operators to understand why these no-shows are occurring, as well as exploring potential solutions to combat the issue.

In this report, we reveal the extent of the no-shows problem, including current consumer booking behaviours and the factors influencing no-show rates, as well as how likely consumers are to show up for their booking in hospitality compared to other sectors.

“No-Shows is a really big problem for the industry. At our restaurant Faber, we charge a £20 per head pre-authorisation (the money is only taken in the event of no show) on every booking, as we have to protect our business. Hospitality is unique in the sense that unlike many other industries, you pay after you’ve received the service. When people don’t show up, not only is the money from the booking lost, but the costs incurred from the stock which was ordered in that we now have to waste and the additional staff which were put in place to support the booking, all add up. It all has a negative effect on business.”

Join the conversation and help us make no-shows a thing of the past

No-shows cost the hospitality industry an estimated £17.59 billion in lost sales every year. Join our group of passionate industry supporters to help spread the message far and wide and encourage customers to #ShowUpForHospitality.

With consumer spend tightening and visit frequency reduced, a loyal customer base providing that all-important repeat business is the holy grail for operators looking to succeed in today’s difficult trading landscape.

Our previous research in partnership with CGA by NIQ revealed that consumers, on average, feel loyal to 2.1 hospitality brands – but how likely are their choices of preferred venues to change?

In this exclusive survey of 5,000 British hospitality consumers, we reveal how likely consumers would be to switch their preference to a different hospitality brand, how hospitality stacks up against other sectors, and the role loyalty schemes play in ensuring customers keep coming back to you for more.

GO Technology: Consumers and hospitality: What 2025 habits reveal about the year ahead

GO Technology: The new age of pub service

GO Technology: The social value of hospitality

GO Technology: More Than a Meal

GO Technology: Why 6:12pm is the new 8pm

Pub Accommodation Review 2025

GO Technology: Hotels and consumers – Guest expectations and how to meet them

GO Technology: Consumers and hospitality: 2024 in review

Our previous GO Technology research revealed that hospitality still plays an important role in people’s social lives despite cost pressures, but with 49% of consumers saying they’d become less loyal to a brand after a few bad experiences, it’s incredibly important for hospitality businesses to deliver frictionless experiences that meet guests’ expectations, without any frustration during the journey.

This exclusive research of 5,000 hospitality consumers reveals the biggest frustrations guests encounter when engaging with venues, both in-venue and pre-visit, how these frustrations differ between demographics, and what actions they are likely to take following a frustrating experience.

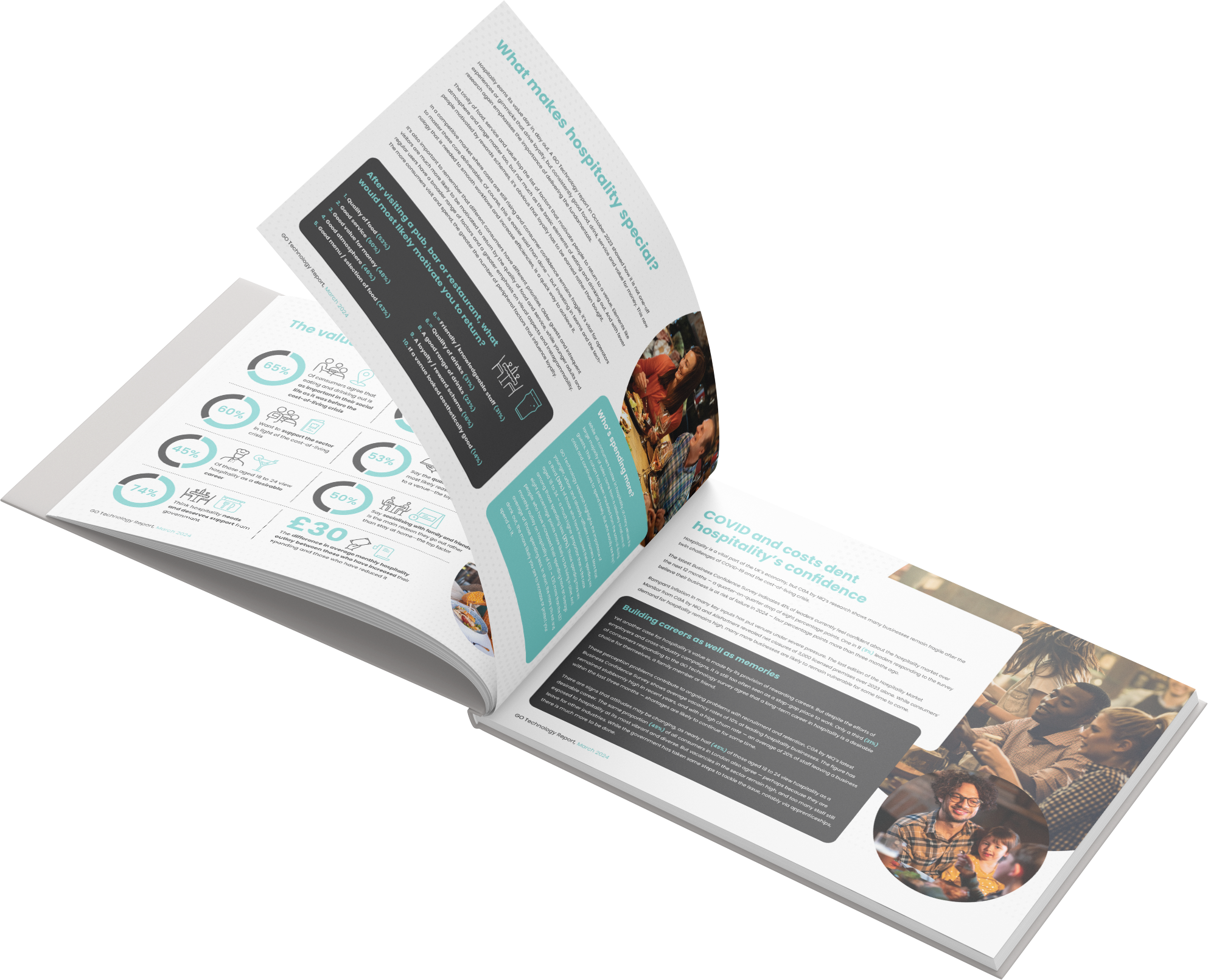

Despite many consumers tightening their purse strings, hospitality still has a vital role to play in the social lives of Britain’s consumers. But what is it about hospitality that consumers really and truly value?

This exclusive consumer research of 5,000 GB consumers, conducted in partnership with UK Hospitality and CGA by NIQ , reveals what aspects of the industry consumers love the most; from why people choose to go out instead of staying in, to what aspects of a pub, bar or restaurant’s offering would keep making them come back for more.

Consumer expectations of the pubs, bars and restaurants they visit are ever-changing, and 2023 has proven to be no exception to the rule. This year, consumers have been quick to change their behaviours to match the tightening of budgets brought on by the cost-of-living crisis, and as more and more consumers become digital natives, the shift towards more digital-led touchpoints has continued to grow.

In this in-depth review of our 2023 consumer research series, we explore the three key themes identified from our surveys of 5,000 hospitality consumers; from the influential consumers who make the decisions on where to eat and drink, to when guests prefer digital touchpoints to human interaction during the customer journey, and how guest loyalty has changed as a result of the cost of living crisis.

Loyal customers are an incredibly valuable asset for any hospitality business, providing a lucrative source of repeat business and resulting revenue as well as brand advocacy that entices new guests in through your doors.

Maintaining a loyal customer-base has always been a key objective for operators, however amidst a cost-of-living crisis resulting in tighter consumer budgets, the criteria leading to a customer becoming, and remaining, loyal have changed. How does loyalty differ between generations? And what role do loyalty schemes play in all of this?

Produced in partnership with CGA by NIQ, we surveyed 5,000 GB hospitality consumers to find the answers.

In today’s hyper-connected, always-on world, going online for many consumers is their first (and only) port of call when searching for pubs, bars and restaurants to visit.

Social media has evolved from a place to keep in contact with friends and family, to an environment where people can also follow and engage with their favourite brands, and search engines have overwhelmingly become the place consumers to go find information about products and services. In more recent years, these platforms have also become the go-to place for customers to make bookings.

But how do customers use social media platforms and search engines to find hospitality venues? What are they looking for? How do they want to book? And more importantly, where is their behaviour headed in the future?

In our latest GO Technology research report, produced in association with hospitality insights company, CGA, and social bookings experts Mozrest, we discovered how 5,000 consumers are using social media and search engines. Download the report to discover how they’re engaging with their favourite hospitality brands on these platforms and the massive opportunities for savvy operators and marketers to leverage Google and social media to boost bookings and generate more revenue – not just now, but in the future.

You’ll discover…

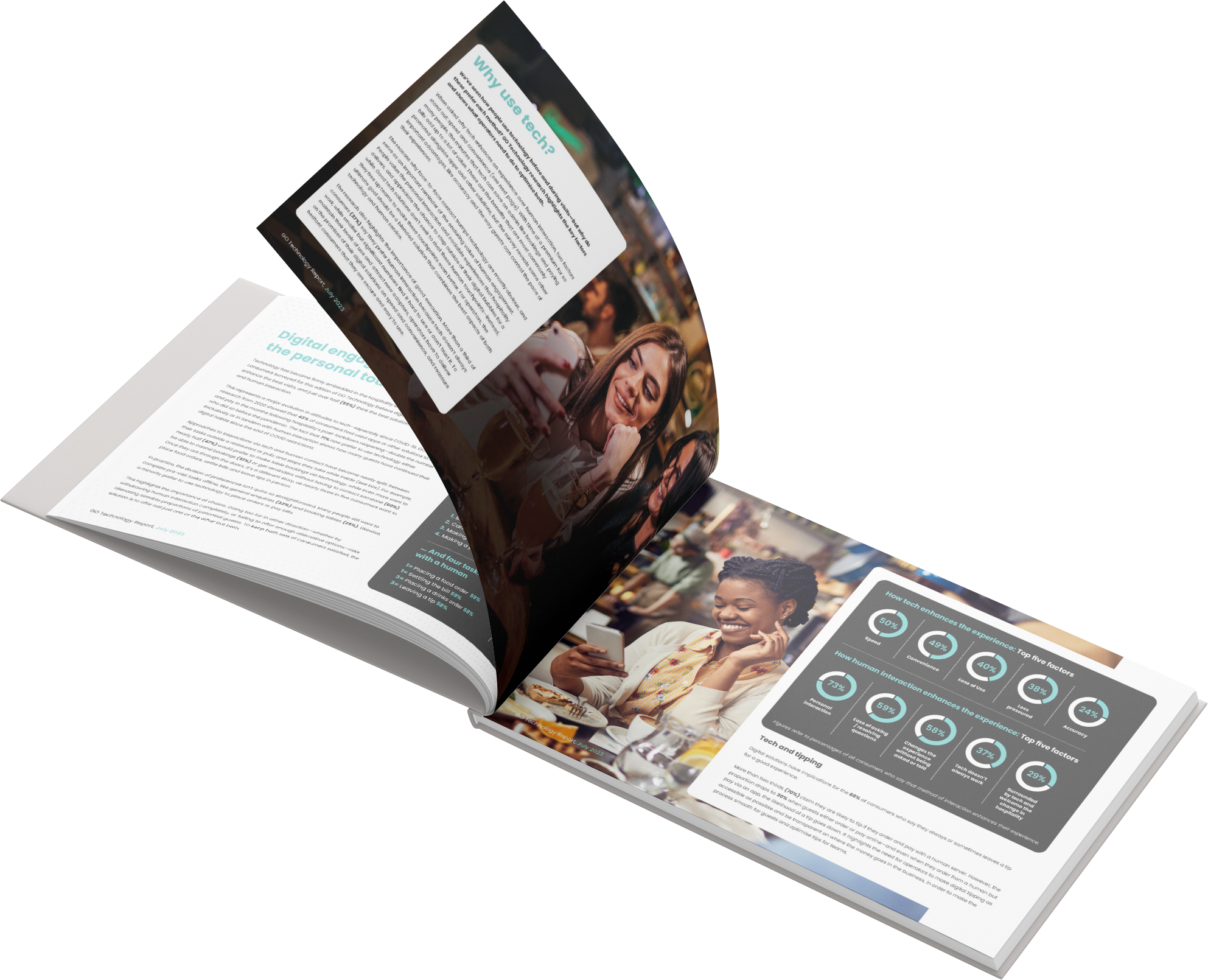

The role of technology in hospitality is evolving – not only are guests used to seeing technology in-venue, they now expect it to be present. But the importance of human connection for which the hospitality industry is known and loved so well, is not to be underestimated.

Produced in partnership with CGA by NielsenIQ, we asked 5,000 UK hospitality consumers to find out their views on technology in hospitality.

With 55% of those surveyed believing that a balance between technology and a human touch delivers the best hospitality experiences, ensuring you’re meeting the expectations of ever-increasingly digitally-savvy guests, will be key for success now, and in the future.

As the cost-of-living crisis continues to squeeze consumer spending and budgets are more closely scrutinised, many guests are opting to leave the decision-making process for which venue to visit, to someone they trust.

These trusted ‘influencer’ consumers represent a significant opportunity for hospitality businesses able to convert them from regular guests into brand champions. But who are these ‘influencers’? What are their hospitality habits? And what do they look for when choosing a venue to visit for their friends, families and networks?

Produced in partnership with CGA by NielsenIQ and DataHawks, we surveyed 5,000 UK hospitality consumers to find out.

2023 is set to be another bumper year for the staycation, with 81% of British hotel guests looking to stay at a UK hotel in 2023, as financial pressures deter international travel and habits formed during the pandemic continue to draw consumers to making their holiday plans within the UK rather than travelling abroad.

But what are guests looking for when booking accommodation? How are they finding it? And what do they expect during their stay?

In our latest GO Technology research report, produced in partnership with hospitality insights firm CGA by NielsenIQ, we surveyed 2,000 hotel guests who have stayed in UK hotels and accommodation in the past six months to find the answers!